Facts About Offshore Business Registration Revealed

Table of ContentsOffshore Business Registration Can Be Fun For Everyone6 Simple Techniques For Offshore Business RegistrationNot known Incorrect Statements About Offshore Business Registration Offshore Business Registration for Beginners

The opinion quoted is for information just and also does not constitute financial investment recommendations or a recommendation to any kind of viewers to get or offer investments. Any kind of market info shown describes the past as well as ought to not be viewed as a sign of future market efficiency. You need to consult your expert consultant in your territory if you have any kind of questions concerning the contents of this short article. offshore business registration.This entails taking steps to increase the conservation and effective transfer of your estate to heirs and also recipients. In doing this, you require to consider that you would certainly like to take advantage of your estate, how and when they should obtain the advantages, and in what proportions. You need to likewise recognize people and/or firms that you wish to supervise of handling the distribution of your estate in an expert as well as trustworthy way.

Liquidity planning also creates part of proper distribution of your estate, to ensure that successors can get the benefits in a timeous, reasonable, and also reliable way. Rich people can profit from the range of solutions which wealth management accounts need to provide. Much of these services might be offered in your house nation, however to maximise your benefits and get the finest wealth administration solutions, it deserves considering utilizing an overseas wealth monitoring technique.

This makes Cyprus an economical, yet high-quality option for those who desire to handle their riches in the EU. Singapore is just one of the largest and most preferred overseas monetary centers in the globe. Singapore has a great reputation as a leading overseas financial territory for high web worth individuals.

Facts About Offshore Business Registration Revealed

Telecommunications as well as mobile financial in Singapore are extremely innovative, Although Malay is formally the nationwide language, English remains in fact one of the most widely made use of and also is the lingua franca amongst Singaporean homeowners. There are restrictions for US people for opening an account in Singapore, which limits the solutions and financial investment options readily available.

The banking market has actually been the primary driving pressure of the Luxembourg economic climate for several years now. The benefit of Luxembourg over other strong European nations is that there are no constraints on non-resident checking account. This makes it among the most accessible offshore banking territories in Europe. Luxembourg is most well-known for their high-grade investment banking services.

A Luxembourg overseas account can be opened up from another location within concerning 2 weeks. There are numerous money that you can pick to denominate your account in. The setup costs in Luxembourg are higher than other nations on this listing, can be found in a little under USD 2,000. Nevertheless, this is a little cost to spend for the series of benefits that a Luxembourg wide range administration account offers.

It is highly a good idea to get the solutions of a skilled and proficient offshore wealth click here for info supervisor to aid you assess and also determine one of the most appropriate options which are readily available to you. They can additionally make sure that the setup procedure is smooth as well as effective.

Unknown Facts About Offshore Business Registration

With extensive experience in the wide range management field, we show integrity to bring you closer to riches supervisors who have a detailed understanding of off-shore financial investment, both globally and also on the Network Islands. We will only link you with wide range managers who will certainly foster a professional trusting connection with you which will certainly motivate self-confidence and also allow your off-shore financial resources to prosper.

There is a great deal of confusion about offshore funds. They key concerns are these:- They can be found in many guises as well as various bundles, so the truth that a fund is offshore tells you nothing about the framework, costs and so on. You have to analyze each fund individually. The policies this hyperlink that govern the overseas financial investment review might or might not suffice.

The 3-Minute Rule for Offshore Business Registration

There can be tax obligation benefits for UK nationals living overseas, (or planning to do so for at the very least an entire tax year) or foreign nationals residing in the UK.

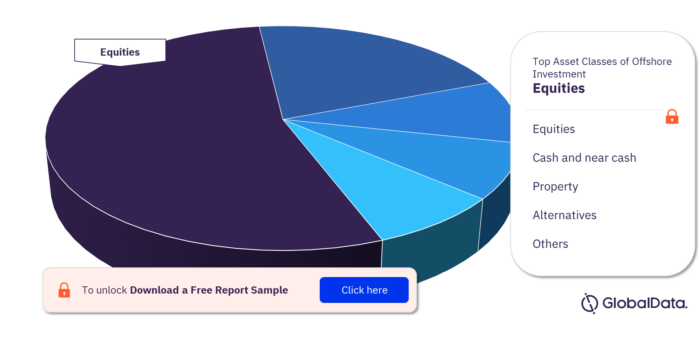

Free Record Europe has been determined as one of the most favorable regions for investors, seeing high financial investment activity in the previous year. A lot of these financial investments have been with Debt Offering, valued at near to $700 billion. The region has actually provided attractive financial investments in a varied collection of business.

Global, Data's whitepaper provides a complete view of the market, evaluating much less successful or attractive points of financial investment as well, checking out statistics on Equity Providing financial investments and also PE/VC bargains. Understand exactly how federal government agencies for economies around the globe usage Global, Data Explorer to: Track the M&An as well as Resources Raising quantities right into their target audience Recognize the leading fields in the target audience drawing in the financial investments For any kind of investment section, determine the leading Financiers inside as well as outside the target economic climate that are already buying the Sector Assess and also showcase the growth potential for various Industries in the target economic situation Don't lose out on key market insights that can assist enhance your following financial investment reviewed the record currently.

While the exact reasons vary, the general trend is in the direction of unfavorable assumptions for onshore financial investments, pressing financiers to offshore economic centres. Wealth supervisors require to acknowledge this defensive stance to offshore investment circulations.